Get daily updates of your credit score with SavvyMoney.

Check Your Credit Score

Stay on Top of Your Credit

SIMPLE Access & Daily Updates

Benefits of SavvyMoney

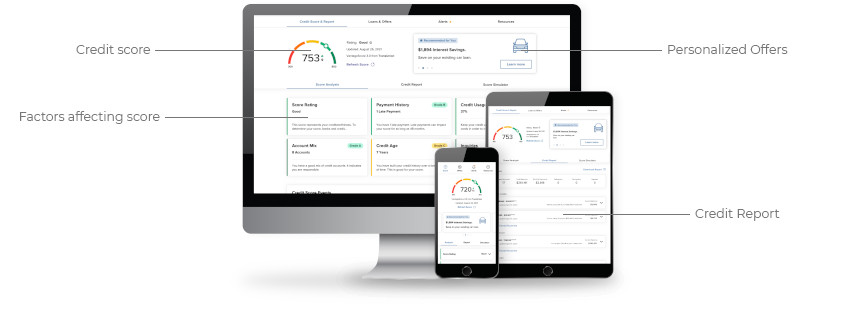

- Instant access to your credit score and credit report

- Receive alerts for major changes

- Take the Financial Check-up Assessment

- Set Credit Score Goals

- Credit Score Simulator Tool

- Get daily updates of your credit score

- Learn how to save money on new and existing loans

- Quickly identify potential fraudulent activity

- Get financial education tips and articles to help you understand the factors that impact your score

Get Started Today

Not an Online Banking user? Create your free account to get started.

Get Instant Answers

SavvyMoney is a comprehensive credit score program offered by Credit Union West, that helps you stay on top of your credit. You get your latest credit score and report, an understanding of key factors that impact the score, and can see the most up to date offers that can help reduce your interest costs.

SavvyMoney monitors your credit report daily and informs you by email if there are any big changes detected such as: a new account being opened, a change in address or employment, a reported delinquency or a new inquiry. Monitoring helps users keep an eye out for identity theft.

With this program, you always know where you stand with your credit.

As long as you are a regular Mobile or Online Banking user, your credit score will be updated every month and displayed in your Online Banking screen.

You can click “refresh score” daily by navigating to the detailed SavvyMoney widget from within Online Banking.

There are three major credit-reporting bureaus - Equifax, Experian and Transunion - and two scoring models - FICO and VantageScore - that determine credit scores.

Financial institutions use different bureaus, as well as their own scoring models. Over 200 factors of a credit report may be taken into account when calculating a score and each model may weigh credit factors differently, so no scoring model is completely identical.

SavvyMoney uses bank level encryption and security measures to keep your data safe and secure. Your personal information is never shared with or sold to a third party.

SavvyMoney pulls your credit profile from TransUnion, one of the three major credit reporting bureaus, and uses VantageScore 3.0, a credit scoring model developed collaboratively by the three major credit bureaus: Equifax, Experian, and TransUnion. This model seeks to make score information more uniform between the three bureaus to provide consumers a better picture of their credit health.

No, SavvyMoney is a free service designed to help you understand your credit health, how to make improvements in your score and ways you can save money on your loans with Credit Union West. Your credit score is not shared with the credit union.

No. Checking SavvyMoney is a "soft inquiry", which does not affect your credit score. Lenders use "hard inquiries" to make decisions about your credit when you apply for loans.

Credit Union West

Member Survey

On a scale from 0-11, how likely are you to recommend Credit Union West to a friend or colleague?