Online BankingClose online banking

How to Skip a Payment in Online Banking

Mobile & Online Banking

Fastest Processing Time

If you're using Skip-a-Pay for a Personal, Auto, RV, Boat, or Motorcycle Loan, the fastest and easiest way to request your skip is in Mobile and Online Banking.

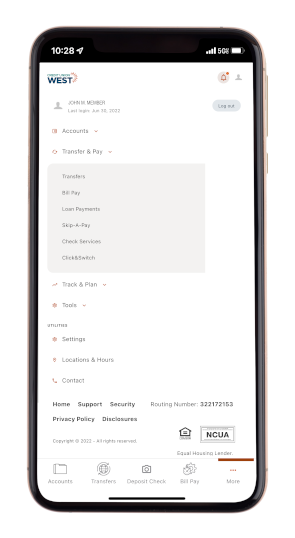

1Log in, and choose Skip-A-Pay from the menu.

|

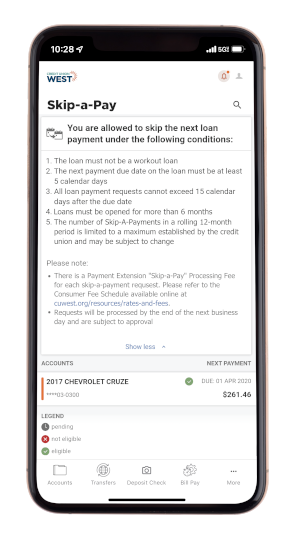

2Click the loan payment that you would like to skip.

|

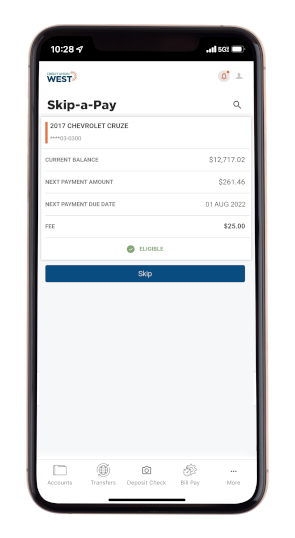

3Review your information, and click Skip. It's that easy!

|

Don't have Online Banking?

Sign up today, it's free, fast and easy - plus, you'll have the quickest processing time on Skip-a-Pay requests.

Or, submit your Skip-a-Pay request through our online form (slower processing times will apply).

¹ A skip a payment fee will be processed per the Credit Union’s Fee Schedule, for each skip a payment request. You may not request two back to back skip a payments. If you have more than one qualifying loan you may request to skip a payment on each loan. Processing fee will be returned to anyone not eligible to participate in this offer. In order to skip your payment, all loans and accounts must be current and in good standing at the time we receive your request, and your loan must be opened for more than 6 months. The deferral of loan payments pursuant to this agreement will automatically extend the loan maturity date by a corresponding period of time. Deferral of payments will reduce the portion of future payments applied to principal resulting in a larger final payment, or negative amortization. Interest will continue to accrue on your loan as it normally does. The number of skip a payments in a rolling 12-month period is limited to a maximum established by the credit union and may be subject to change. Certain restrictions apply and not all loans are eligible for this program. In some instances, it may be required that the member authorize having a credit bureau pulled for review. Subject to credit qualifications and performance. Program subject to change.

Feedback form

Credit Union West

Member Survey

On a scale from 0-11, how likely are you to recommend Credit Union West to a friend or colleague?

There was an error submitting the form